One of the most striking features of the global economy over the last several years has been the complete absence of inflation. If you had told an economist a few years ago that the U.S. unemployment rate would reach 3.9% in 2018 and core inflation would be running below 2.0%, they would have called you crazy. There are varied explanations for the persistence of low inflation, including the retirement of higher wage baby boomers and online shopping making it easier for consumers to do price comparisons.

Whatever the reasons for persistently low inflation, we’ve seen signs in recent weeks that inflationary pressures may finally be building. One bit of evidence in that direction is a sharp increase in transportation costs (trucks and railroads), which is reflected in hard data as well as complaints from CEOs of companies that have been absorbing those cost increases. While inflation in transportation costs have not yet been passed on to consumers, there is only so long manufacturers will be willing to take the hit on their bottom line.

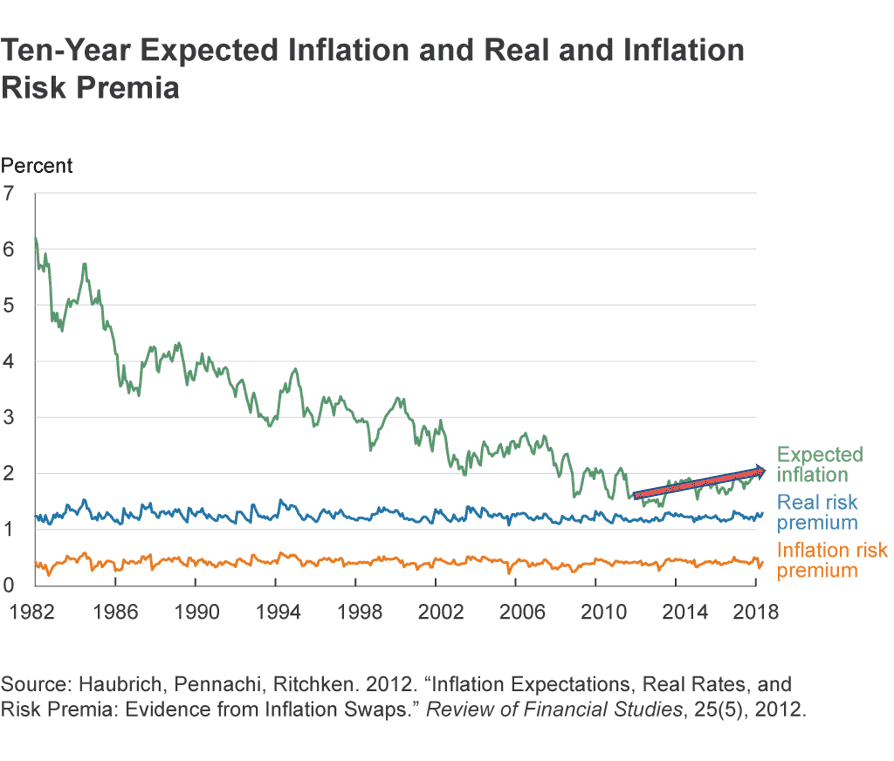

The other interesting piece of data comes from the Cleveland Fed which monitors inflation expectations. They have a complicated model that estimates what level of inflation consumers and businesses are expecting over the next ten years. Historically increases in long term inflation expectations tend to predict relatively short term increases in actual inflation. As the chart below illustrates (trend arrow inserted by yours truly), inflation expectations are rising, and, importantly, are now above 2.0% for the first time since 2010.

We’re not anticipating anything dramatic on the inflation front, but even a steady, sustained increase could force the Feds hand in raising interest rates faster than capital markets are expecting.